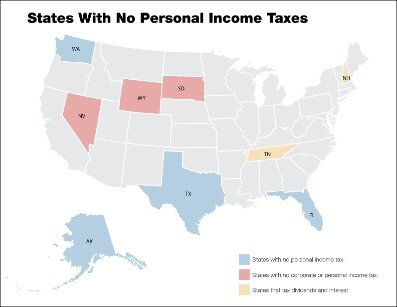

States With No Income Tax Map Printable Map

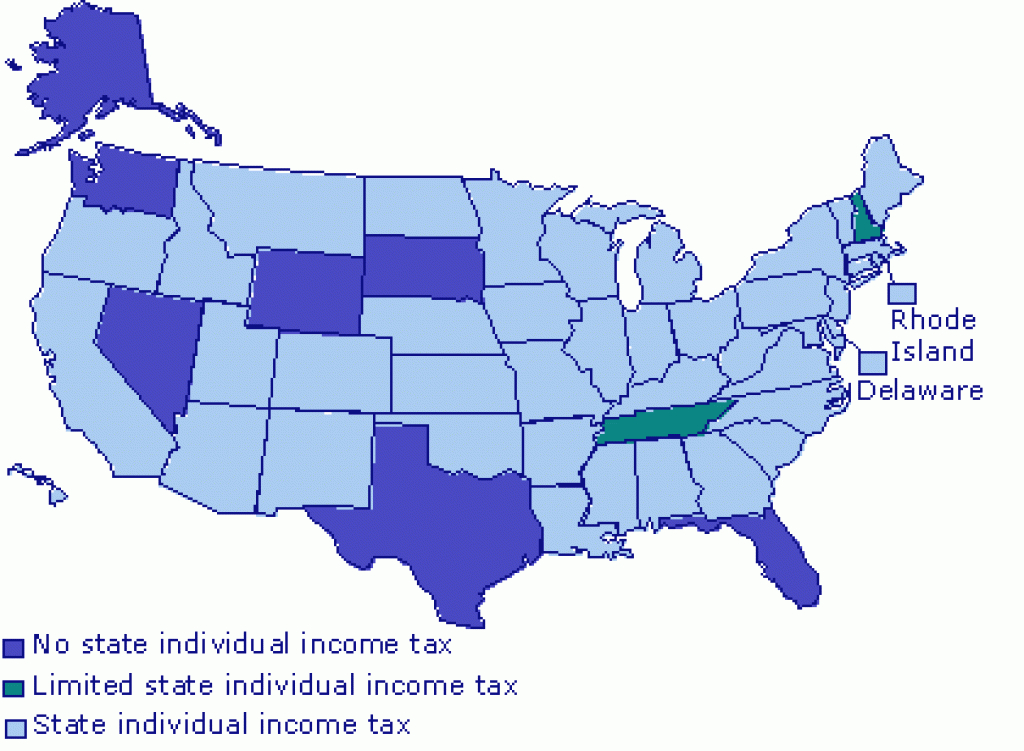

Federal income tax is a necessary evil, but residents in some parts of the country don't have to pay state income tax States have no state income tax, but other revenue sources may still affect how much tax you pay. In 32 states and washington, d.c., residents are subject to a progressive.

Discover 11 Retirement: States with No Income Tax and places to travel

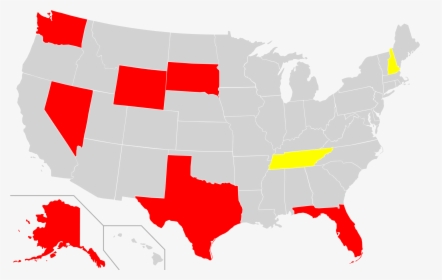

Which states don't charge any personal income tax (which doesn't impact your federal income taxes, by the way)? While it seems great to live in a state where there are no personal income taxes, remember that all states have to generate their own revenue. States with no income tax—plus how washington taxes capital gains, what other taxes you'll likely pay instead, and what to consider before relocating.

Some states also recently cut their income tax rate, meaning millions more americans will get to pay less in income tax this year.

However, it does levy a statewide sales tax of 6 percent, which jumps to an average rate of 7 percent when combined with local sales tax Learn about the states that do not levy a state income tax and how they generate revenue in other ways The state also has one of the highest property tax rates in the nation Washington taxes only capital gains income